Landlords - New Energy Performance Certificate Rules

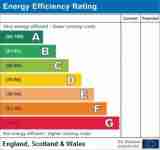

When these laws come into effect it will be unlawful to rent a property that breaches the requirement of a minimum E rating unless there is an applicable exemption. The penalty for failing to comply with these Regulations will be a fine of up to £4,000.

This will mean that Landlords will no longer be able to rent out properties that have an energy performance rating of F or G after the 1st April 2018. It is therefore important that Landlords start planning now to undertake works, if necessary, to raise the energy performance level of their property if they fall outside of these categories.

After the 1st April 2018 if an F or G rated property is to be let then energy efficiency improvements must be carried out to bring the property up to an E rating otherwise it will be unlawful to rent out the property.

Landlords will be classed as letting properties if they: –

Grant a new Assured Shorthold Tenancy.

Renew or extend an existing Assured Shorthold Tenancy with a tenant.

When the statutory period of a tenancy comes into existence following the end of a fixed term of a tenancy. This will be treated as a new letting for the purposes of the Regulations.

When an agricultural occupancy or similar tenancy is granted, renewed or extended.

From the 1st April 2020 all existing tenancies have to be brought up to a minimum energy performance standard of E.

Exemptions

It is possible to have an exemption from these rules if one of the following applies: –

The Landlord has undertaken improvements that are cost effective but the property remains below an E rating in respect of an EPC. Cost effective measures are defined as those which are capable of being installed within the Green Deal Golden Rule.

Where a Landlord is unable to obtain funding via the Energy Company Obligation, Green Deal Finance or Local Authority Grants.

Where a Landlord requires the tenant’s consent under the terms of the Tenancy Agreement to undertake the work and the tenant withholds that consent.

Measures required to improve the property are evidenced by a suitably qualified independent Survey for example a member of the Royal Institute of Chartered Surveyors (RICS) as expected to cause a capital devaluation of the property of more than 5%.

There are also temporary exemptions if a tenant becomes insolvent and the guarantor takes over the tenancy or from the 1st April 2018 onwards a temporary exemption applies where someone becomes a Landlord upon purchasing an interest in a property and on the date of purchase it is let on an existing tenancy.

Any exemptions claimed will have to be registered on the PRS Exemptions Register that is operated by the Government. This opened on the 1st October 2017 and it is basically a database of all exemptions and it is open to public inspection.

The duration of any exception will only last for 5 years after which the Landlord must comply with the new Regulations.

For more information about these new Regulations please call our offices on 01654 711499 or email abright@alwenajonesbright.co.uk

Links

Offices

Social

Bright Solicitors